That heart-stopping moment: your phone dings. A message appears — “DVLA” flashes on the screen. An unfriendly tone in the message claims you have an unpaid parking penalty charge and threatens legal action unless you settle the fine without delay.

At that point, does panic set in? Or do you pause and smell a rat?

If that scenario feels chillingly plausible, then you’re experiencing the relentless scam epidemic firsthand. Every single day, sophisticated fraudsters target millions with alarming precision.

However, here’s the empowering truth: uncovering scammers isn’t just reserved for detectives or cybersecurity experts. With a few sharpened instincts and the right awareness, you too can become adept at spotting the traps — and protecting your hard-earned pounds and peace of mind.

So, consider this your practical field guide — a spotlight to expose the fraudsters working tirelessly to siphon your trust, time, and money.

The Scam Landscape: Bigger, Bolder, and More Costly Than Ever

Let’s grasp the sheer scale hitting British pockets and businesses:

- The Staggering Cost: UK Finance reported £1.17 BILLION lost to authorized push payment (APP) scams and fraud in 2023 alone. When you add unauthorized fraud, the total exceeds a devastating £2.3 billion. That’s billions stolen from individuals, families, and businesses across the nation.

- Who’s Targeted? Everyone. From teens duped by fake’ influencer giveaways’ to pensioners devastated by investment cons or “courier fraud.” UK Finance data shows purchase scams (buying fake goods) are now the most common, but impersonation scams (like fake banks or HMRC) cause the highest losses. Action Fraud receives hundreds of thousands of reports yearly.

- The Sophistication Surge: Forget clunky emails. Today’s UK scammers use spoofed numbers mimicking your bank, deepfake voice technology to impersonate loved ones (“Hi Mum, Hi Dad” scams), fake social media profiles, and exploit data breaches. They monitor local news and trends for believable hooks.

Common UK Cons & Their Telltale Signs: Know Your Enemy

While scams evolve, core patterns emerge. Recognizing these UK-specific tactics is your first defense:

- The Authority Imposter

- Fake calls/texts claiming to be your bank (urgent security alert!), HMRC (tax arrest threat!), Royal Mail (missed delivery fee!), or even the police (your account is compromised!).

- Goal: Panic you into sending money or revealing security details. (UK Finance: APP Scams)

- The Too-Good-To-Be-True Deal:

- Fake marketplace listings (Facebook Marketplace, Gumtree), “investment opportunities” (crypto, forex with guaranteed high returns – often via Instagram or WhatsApp), fake lottery wins, or miracle health products.

- Goal: Exploit greed or desperation for a “bargain.” (FCA Warning on Crypto Investment Scams)

- The Personal Crisis Imposter:

- “Hi Mum/Dad” texts claiming to be a child needing money urgently for a broken phone/bail. Romance scams on dating apps where the “partner” suddenly needs funds for a visa or medical emergency.

- Goal: Exploit love and concern. (National Trading Standards – Friends Against Scams)

- The Phishing Hook (UK Style):

- Emails/texts mimicking TV Licensing, DVLA, energy suppliers (fake refunds/overdue bills), or parcel firms. Fake “security alerts” from PayPal or Amazon UK.

- Goal: Steal login credentials, card details, or personal data. (National Cyber Security Centre (NCSC) – Phishing Guidance)

- The Tech Support Scam:

- Pop-ups claiming your PC is infected, cold calls from “Microsoft” or “BT Security.”

- Goal: Gain remote access to install malware or demand payment for fake fixes. (Which? Tech Support Scams)

Comparison: Top UK Scams & How to Spot Them

| Scam Type | Common Delivery | Psychological Hook | Major UK Red Flags | Real-World UK Example |

|---|---|---|---|---|

| Bank Impersonation | Phone Call, SMS, Email | Fear, Urgency | “Urgent security breach!” Demand to move money to a “safe account.” Spoofed bank number. | Caller ID shows your bank’s real number. |

| HMRC / Tax Scam | Phone Call, Voicemail | Fear, Authority | Threats of arrest, lawsuit, bailiffs. Demand payment via gift cards or crypto. | “Final notice” voicemail demanding iTunes cards. |

| Purchase Scam | FB Marketplace, Gumtree | Greed (Amazing Deal) | Item priced well below market. Seller pressures for bank transfer. Avoids platform protection. | “Brand new” iPhone 15 for £300, bank transfer only. |

| Hi Mum/Dad (Courier) | WhatsApp, SMS | Love, Urgency, Panic | New number: “Mum/Dad, phone broke! Need money NOW for bill/bail.” Courier sent to collect cash/cards. | “Hi mum, smashed phone. Can u send £300 via bank? New number.” |

| Investment ‘Opportunity’ | Instagram, WhatsApp | Greed, Exclusivity | Unsolicited contact, “guaranteed” high returns, pressure to invest quickly. Fake FCA registration. | “Exclusive” crypto chance via WhatsApp, fake FCA number. |

| Parcel Delivery Fee | SMS, Email | Curiosity, Minor Fear | “Missed delivery! Pay £2.99 fee to reschedule.” Link leads to phishing site. | Fake Royal Mail text with tracking link. |

Your UK Scam-Busting Toolkit: How to Verify and Uncover

Uncovering scammers means playing detective – questioning everything and verifying independently.

- Interrogate the Contact (The Golden Rule):

- Urgency & Pressure: “Act NOW or your account is closed/arrested!” This is the scammer’s greatest weapon against your logic.

- Unusual Payment Demands: GIFT CARDS (iTunes, Google Play, Steam), bank transfers (especially to a “safe account”), cryptocurrency. Legitimate UK authorities/businesses NEVER demand payment this way. HMRC won’t call threatening arrest. Your bank won’t ask you to move money externally.

- Caller ID/Sender Address: SPOOFING IS RIFE. Never trust the displayed number or email “From” name. Hang up and call back using the official number from the company’s website, your bank card, or a bill. For emails, check the exact sender address –

service@hmrc-gov.uk.comisn’t HMRC! - Grammar & Tone: While sophisticated scams are polished, poor grammar, overly aggressive threats, or an unprofessional tone can be clues.

- Leverage Verification Resources:

- FCA Register Check: For any investment opportunity, check the firm/person is genuinely authorised on the Financial Conduct Authority (FCA) Register. Be wary of cloned firms!

- Company House Lookup: If dealing with a UK business, verify its existence and details on Companies House.

- Reverse Image Search (Google/TinEye): Profile pictures on dating apps or marketplace sellers are often stolen. Right-click and search.

- Phone Number/Email Search: Google the number/email address + “scam”. Check sites like WhoCalledMeUK. Look for patterns.

- Website Checks: Hover over links (don’t click!) to see the real destination. Check for HTTPS and a valid UK business address/contact details (not just a form). Search the website name + “scam” or “review”.

- Spot Behavioural Red Flags:

- Reluctance to Meet/Call/Video Chat: Romance scammers or fake sellers always have excuses.

- Vague or Shifting Stories: Details don’t add up or change when questioned.

- Requests for Secrecy: “Don’t tell your bank,” “It’s a surprise, don’t tell family.” Scammers fear scrutiny.

- Too Good to Be True: That dream rental flat in London at half-price? The “risk-free” investment? Trust your gut.

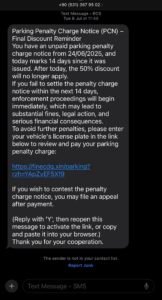

A UK Close Call: The Fake “HMRC” Voicemail

Recently, my phone received a message: “This is PCN. Final Discount Reminder. You have an unpaid parking penalty charge notice…” The sending number displayed a non-local prefix, which was obviously the first giveaway , not an official PCN line. Instead of panicking (which I did by the way), I knew the golden rule: PCN does NOT send threatening messages demanding immediate payment, especially via untraceable methods. This reinforced: Official UK bodies communicate major issues by post first. Threats over the phone are almost always scams.

Fortifying Your UK Defences: Proactive Protection

Uncovering scammers is vital, but prevention is better than cure:

- VERIFY INDEPENDENTLY: Always! Hang up, find the official number/website yourself, and contact them directly. Never use details provided in a suspicious call/message.

- Payment Protocol:

- Gift Cards = Scam: Legitimate entities never ask for payment via iTunes, Google Play, Steam, or Amazon vouchers.

- Bank Transfer Caution: Be extremely wary of transferring money to someone you don’t know personally, especially for goods or services. Use platforms with buyer protection (like PayPal Goods & Services, not Friends & Family) where possible. Know your bank’s APP scam policy under the Contingent Reimbursement Model Code.

- Credit Cards: Use credit cards for online purchases for stronger Section 75 protection.

- Strengthen Digital Hygiene:

- Strong, Unique Passwords & 2FA: Use a password manager. Enable Two-Factor Authentication (2FA) on all important accounts (email, banking, social media). The National Cyber Security Centre (NCSC) has excellent guidance.

- Update Everything: Keep your phone, computer, router, and apps updated.

- Guard Personal Info: Be stingy on social media. Don’t share DOB, mother’s maiden name, etc., unnecessarily. Shred post with personal details.

- Educate & Communicate: Talk openly with family – especially older relatives – about common scams. Share warnings from Which?, Citizens Advice, or National Trading Standards. Break the silence scammers rely on.

The Power of Reporting: Fighting Back Across the UK

Uncovering scammers isn’t just personal; it’s a community effort. Reporting is crucial:

- Report to Action Fraud: The UK’s national reporting centre for fraud and cybercrime. Report online at actionfraud.police.uk or call 0300 123 2040.

- Report to Your Bank: Immediately if you’ve sent money or shared details. They can try to recall funds and investigate.

- Report to the Platform: Report fake profiles, listings, or messages to Facebook, Gumtree, WhatsApp, etc.

- Report Phishing: Forward suspicious emails to report@phishing.gov.uk (NCSC).

- Tell Friends & Family: Warn your network about specific scams you encounter (without spreading panic).

Conclusion: Your Vigilance is the Ultimate Defence

The UK scam landscape is complex and constantly evolving, but it’s not unbeatable. Uncovering scammers hinges on awareness, relentless verification using UK resources, trusting your instincts, and proactive security. By understanding the common cons targeting the population – the imposters, the fake deals, the emotional manipulations – and equipping yourself with verification tools, you transform from potential victim into a vigilant defender.

Remember, these fraudsters are professionals exploiting trust and human nature. Your superpower is healthy scepticism combined with knowing how to check independently. When that urgent HMRC call comes, that unbelievable bargain pops up, or your “child” texts in panic, PAUSE. Breathe. Verify properly. Ask questions. Don’t let manufactured pressure override your common sense.

Your Turn: Let’s Keep Uncovering Scammers Together!

Have you spotted a scam? What was your “aha” moment? What verification tips do you swear by? Share your experiences and advice in the comments below – your insight could protect a fellow victim from devastating loss.

Stay sharp, stay informed, and let’s keep pulling back the curtain on these fraudsters in operation.